Variance analysis 2.2.4

Variance analysis - Calculating and investigating the difference between actual results and the budget.

Management by exception - the process of focusing on activities that require attention and ignoring those that appear to be running smoothly

Variances can be either:

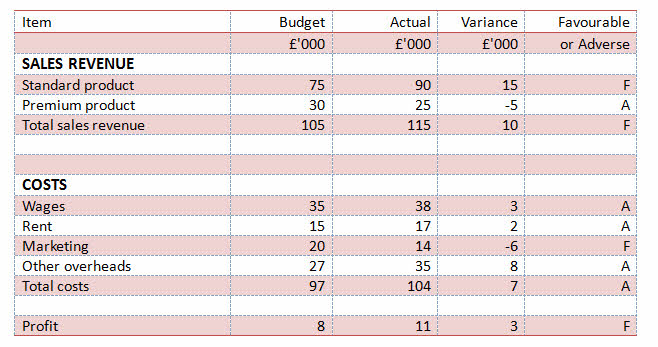

Looking at the sales revenue section, you can see that actual sales of standard product were £15k higher than budget – this is a positive (favourable) variance.

Turning to the costs section, actual wages were £3k higher than budget – i.e. an adverse (negative) variance.

Overall, the profit variance was positive (favourable) – i.e. better than budget

The significance of a variance will depend on factors such as:

Budget control and analysis of variances facilitates management by exception since it highlights areas of business performance which are not in line with expectations.

Items of income or spending that show no or small variances require no action. Instead concentrate on items showing a large adverse variance.

Are all adverse variances bad news?

Here is a point that students often find hard to understand – or believe!

An adverse variance might result from something that is good that has happened in the business.

For example, a budget statement might show higher production costs than budget (adverse variance). However, these may have occurred because sales are significantly higher than budget (favourable budget).

Variance - arises when there is a difference between actual and budget figures.

Management by exception - the process of focusing on activities that require attention and ignoring those that appear to be running smoothly

Variances can be either:

- Positive/favourable (better than expected)

- Adverse/unfavourable ( worse than expected)

- Expenditure was lower than expected in the budget

- Profits were higher than expected

- Income was higher than expected

- Expenditure was higher than expected in the budget

- Profits were lower than expected

- Income was lower than expected

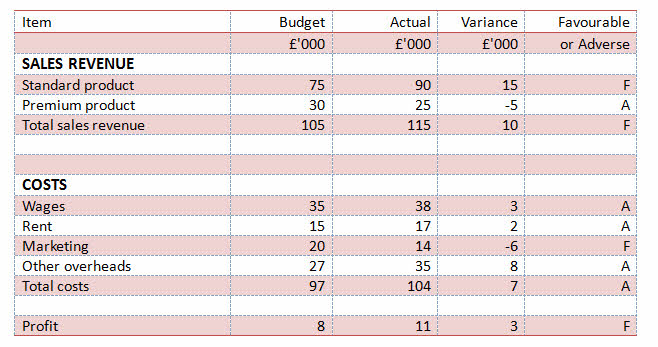

Looking at the sales revenue section, you can see that actual sales of standard product were £15k higher than budget – this is a positive (favourable) variance.

Turning to the costs section, actual wages were £3k higher than budget – i.e. an adverse (negative) variance.

Overall, the profit variance was positive (favourable) – i.e. better than budget

The significance of a variance will depend on factors such as:

- Whether it is positive or negative – adverse variances (negative) should be of more concern

- Was it foreseen?

- Was it foreseeable?

- How big was the variance - absolute size (in money terms) and relative size (in percentage terms)?

- The cause

- Whether it is a temporary problem or the result of a long term trend

Budget control and analysis of variances facilitates management by exception since it highlights areas of business performance which are not in line with expectations.

Items of income or spending that show no or small variances require no action. Instead concentrate on items showing a large adverse variance.

Are all adverse variances bad news?

Here is a point that students often find hard to understand – or believe!

An adverse variance might result from something that is good that has happened in the business.

For example, a budget statement might show higher production costs than budget (adverse variance). However, these may have occurred because sales are significantly higher than budget (favourable budget).

POSSIBLE CAUSES OF VARIANCES

Action of competitors

- Lower prices

- Introduce a new product

- Close a store

Action of suppliers

- Change prices

- Offer a discount

Changes in the economy

- Changes in interest rates

- Increase to minimum wage

Internal inefficieny

- Poor management of a budget

- Demotivated sales team

Internal decision making

- Change suppliers

- Special promotions

- Increase/decrease in expenditure

Comments

Post a Comment